Why Gold?

Gold is honest money. Unlike paper or fiat money, which we all have been forced to use, its value cannot be undermined by the creation of endless new supplies via accounting entries and the printing press. As honest money with intrinsic value, gold has survived as a currency for thousands of years, while every form of paper money created over that time has become defunct.

Gold is honest money. Unlike paper or fiat money, which we all have been forced to use, its value cannot be undermined by the creation of endless new supplies via accounting entries and the printing press. As honest money with intrinsic value, gold has survived as a currency for thousands of years, while every form of paper money created over that time has become defunct.

Every fiat currency ever created through history has vanished. The U.S. dollar, which is the world's reserve currency, will be no exception. Unfortunately, when currencies evaporate toward zero from the thin air they came from, wealth denominated in those currencies also heads toward zero. Only by allocating some of your wealth to a money that does not derive its value from the ability of others to pay their debts, will you survive financially when the dollar also heads toward zero. That time-proven money is gold and sometimes silver.

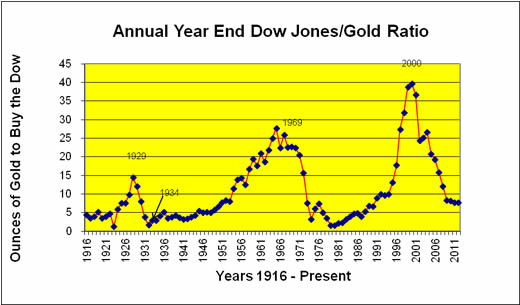

Even during times when the dollar has survived, gold included as part of an investment portfolio has served investors very well. During the century just ended, there were three major peaks for the Dow Jones Industrial Average, as measured in ounces of gold. Most certainly, the first two peaks marked the beginning of devastating stock market declines and huge bull markets in gold. Despite the rise in stocks this past year, evidence is mounting that the December 2000 peak, when 39.95 ounces of gold were required to buy the Dow, will turn out to mark a major reversal in the price of equities and gold. At the end of 2011, it took "only" 7.76 ounces of gold to buy the Dow. What is important for you to understand is that when equity prices bottom, if history is our guide, we can expect that we will be able to buy the Dow for only 1 ounce of gold! This is just one reason we are so bullish on gold and so bearish on the Dow and other dollar-denominated assets.

1929 Stock Market Crash a Buy Gold/Sell Stocks

The DJIA lost almost 90% of its value from its 1929 peak until its 1932 low and the Great Depression followed. During that time, gold rose in price by 69% (from $20.67 to $35.00)! As a result, by 1932, it took as little as 1.99 ounces of gold to buy the Dow compared to a stock market peak of over 12 ounces.

1969 Bull Market Peak a Buy Gold/Sell Stocks

Stocks not only declined significantly but also remained in a bear market for thirteen years until the existing bull market began in 1982! Meanwhile, gold rose in price by 2,382% (from $35.00 to $850.00 in January 1980)! At the Dow peak, it took 22.75 ounces of gold to buy the Dow. However, by January 1980, it took 0.89 oz of gold to buy the Dow!

2000 Stock Market Bubble a Buy Gold/Sell Stocks

History always repeats itself, though never exactly in the same way. Although the Dow is off from its highs, it remains extremely high relative to its historical PE ratio but also in relation to gold. At the end of 2003, despite a significant rise in the price of gold, more than 25 ounces of gold were still required to buy the Dow. That's down from its absurd high of nearly 40 ounces at the end of 2000, but still near its high at the time of the 1966 stock market peak, and much higher than in 1929 before the stock market crash.

Accordingly, we have instituted a strategy aimed at allowing investors to not only survive but to thrive in a devastating decline in equity prices as well as the U.S. dollar. See a description of our Model Portfolio.

WHY GOLD?

- Gold is durable. That’s why we don’t use wheat.

- Gold is divisible. That’s why we don’t use diamonds.

- Gold is convenient in that it is portable and very valuable. That’s why we don’t use lead.

- Gold is consistent. That’s why we don’t use real estate.

- Gold is value in and of itself. That’s why we don’t use paper.