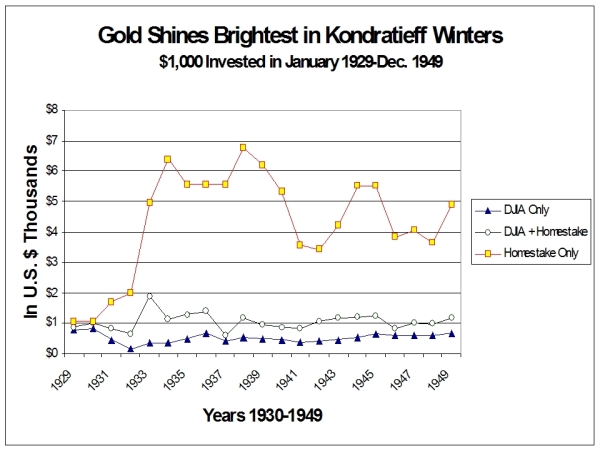

Slide #18 - Gold shines brightest in the Kondratieff winters

Gold does well in the Kondratieff summer as inflation rears its ugly head. However, gold does even better in the Kondratieff winter as people lose confidence in the fiat money banking system. They seek an asset money like gold because its value is not dependent on the ability of others to pay their debts. And as the Kondratieff winter proceeds, debts are increasingly difficult to pay off. As a result, people demand real money like gold or silver before they agree to exchange goods and services and therefore, the demand for gold rises dramatically, as does its price.

Since Americans were not allowed to own gold during the Great Depression, slide 18 shows the result of Homestake Mining ( a surrogate for gold). A $1,000 investment in Homestake in 1929 would have grown to nearly $7,000 by 1938. By 1949 when the last Kondratieff winter ended, that $1,000 investment in Homestake would have been worth about $5,000. By contrast, an investment in the Dow only would have lost about half of its value over this 20 year period and would have been 'under water' the entire 20 years. A portfolio with 40% in Homestake and 60% in the Dow would have fared better. It would have been in positive territory for most of the 20-year period, and it would have been slightly positive by 1949.