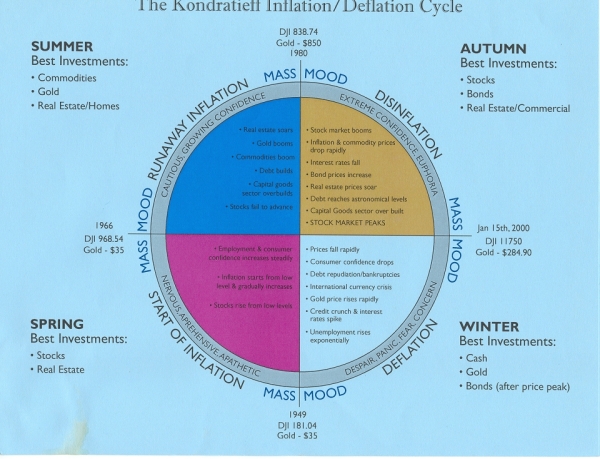

Slide #17 - The Kondratieff Inflation/Deflation Cycle

This slide, compliments of my friend Ian Gordon, illustrates what kinds of investments will perform best during the different phases of the Kondratieff cycle. In the Kondratieff spring, when a new cycle begins, stocks and real estate do very well. In the Kondratieff summer, commodities, gold and real estate/homes do the best. In the Kondratieff autumn, stocks, bonds, and real estate do very well. In the Kondratieff winter, gold and cash are the best investments, and after the debt deflation is broken (at which time interest rates peak), bonds also become a great investment.

Where are we now in this cycle? I believe we are in the very early stages of the Kondratieff winter, which began with the stock market peak in 2000 (as is always the case at the start of the Kondratieff cycle). We have yet to see anything like a peak in interest rates so that there will be tremendous carnage still to come in the bond markets. However, real estate and cash should perform well as stocks and bonds do extremely badly over the next decade.