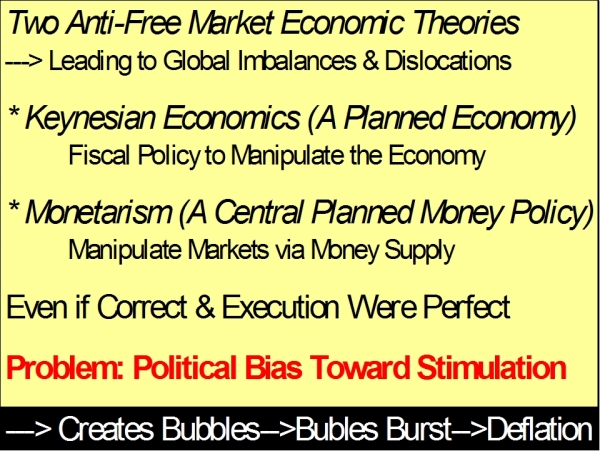

Slide #2 - Two anti free-market economic theories

Policy makers in America and in most of the world base their policies on Keynesian and monetarism, which are two economic theories that are anti free-market theories. Keynesian believes that government should intervene against the natural workings of the market by way of government spending and taxing policies so as to speed up (stimulate) the economy or slow it down. Monetarism believes policy makers (the Fed) should stimulate the economy or slow it down by increasing or decreasing the money supply, which is the same as increasing or decreasing interest rates.

Even if you believe in the validity of Keynesian and monetarist economic theories, and even if somehow policy makers possessed sufficient wisdom to know exactly how much money to inject into the economy and how much government spending and taxing to implement, clearly these theories still have a problem'namely that there is a political bias toward stimulation and a prejudice against policies that slow down economic growth. Accordingly, the implementation of these two economic theories has resulted in bigger and bigger financial bubbles. Ultimately bubbles burst, and when they burst, deflation is the ultimate outcome.