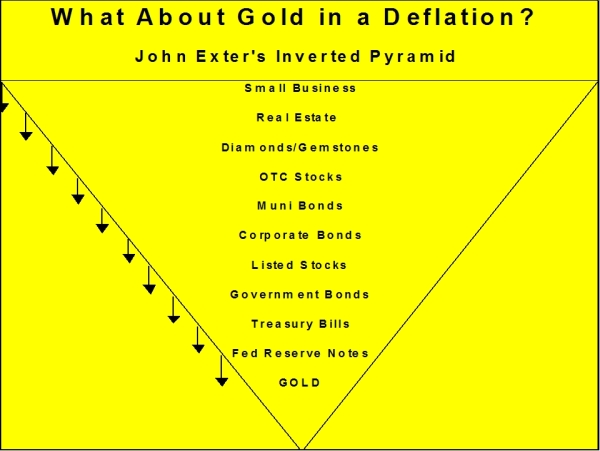

Slide #8 - John Exter's inverted debt deflation pyramid

John noted that banks tend to borrow short term and lend long term. During an expansion (inflationary period), more and more wealth accumulates in the least liquid assets. At some point, debt becomes so great under a fiat currency system that people begin selling off the illiquid assets to be able to make their debt payments and to meet life's every day needs. And so, assets like small businesses, real estate, diamonds/gemstones, and OTC stocks are sold to acquire more liquid assets such as gold, Federal Reserve notes (cash) and T-Bills. The result is a collapse of values in the less liquid asset categories. John Exter preached in the late 1970s and early 1980s that we would inevitably face a debt collapse as bad or much worse than that of the 1930s. But here we are 24+ years later and we have not had anything like Exter's deflationary collapse. Was Exter wrong or was he simply premature in his forecast?